The Anatomy of a Mortgage Payment

Mortgage: While the common English translation – a huge chunk of money going out the door every month –strikes fear in every American homeowner, just think how the French must feel.

In French, mortgage translates to “death contract.” That sounds even scarier until you understand that the “death” of which they refer means the death of the contract. That happens when the pledge is paid or the lender takes the home in foreclosure.

The word “mortgage” is rather confusing to those outside of the real estate industry but it shouldn’t be. Instead of mortgage, think “loan.”

The “Legs” of a Mortgage

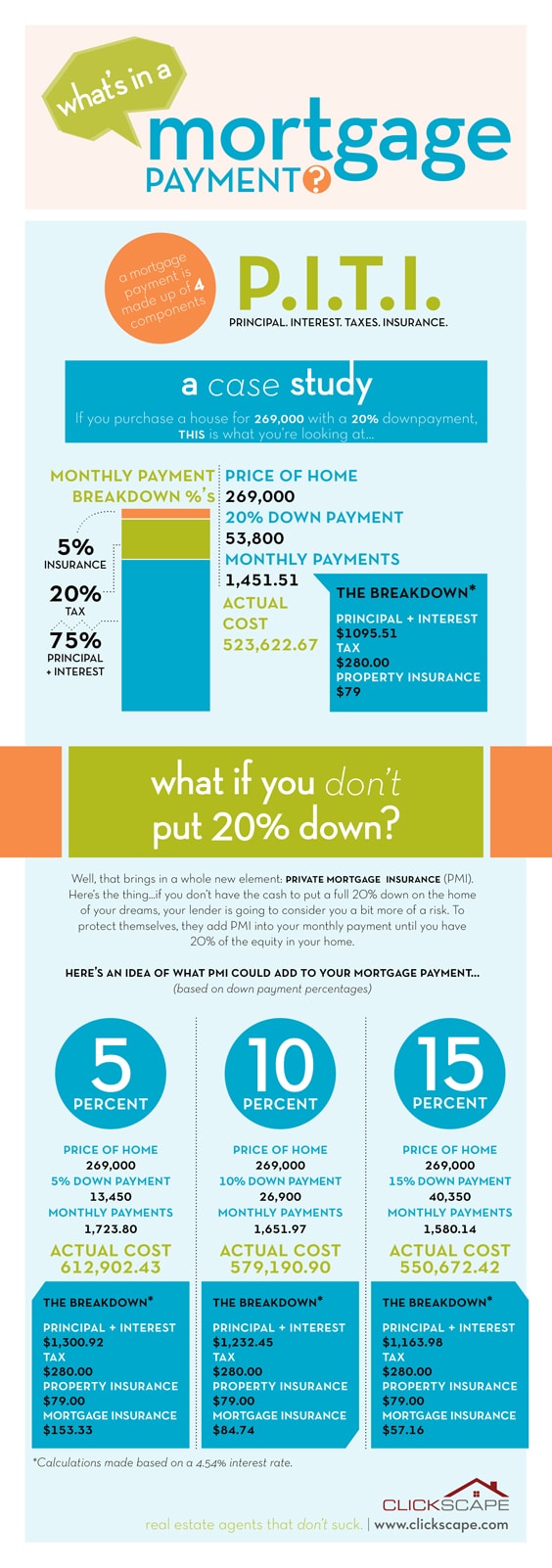

A mortgage has four “legs,” known in the industry as P.I.T.I. You can pronounce this at pee-tee, or pity, it doesn’t matter. What does matter is that it stands for principle, interest, taxes and insurance. These are the four elements of your mortgage payment. It’s what you pay for every month.

Let’s take a look at each of these.

Principle

How much did you borrow from the lender? That amount is your principle. It doesn’t include anything but the amount you borrowed – the amount on which the interest is calculated.

Interest

Interest is something most borrowers are familiar with. This is the fee you will pay the lender for allowing you to borrow the money. Expressed as a percentage, most borrowers are familiar with the interest rate.

Interest payments start off big and become smaller as your loan is paid down.

Taxes

The amount you’ll pay in property taxes (or “real estate taxes”) will vary, depending on where you live. Believe me – they can vary wildly.

Let’s put it this way: a savvy buyer will ascertain the taxes required on a home before making the offer to purchase.

Insurance

Homeowner’s insurance is a necessary evil. Want a loan? Get insurance or you won’t get the loan.

Insurance premiums are kept in an escrow account and the lender pays for them out of the account.

Now, don’t confuse this insurance with PMI – or Private Mortgage Insurance. That’s a separate deal, and required on conventional loans if you put less than 20 percent of the purchase price down on a home.

That’s your mortgage payment in a nutshell. Of course, I’ve only given you the basics. One of our lending partners can go into greater detail, if you’re curious.