Understanding your Credit Score

One thing that we as real estate agents try to make abundantly clear is that the first step toward buying a house is to see a lender. This doesn’t mean after you go online and fall in love with a home, or hopping in the car to go look at open houses. It means first – as in primary – as in buying a house is a step-by-step process and seeing a lender is the first step.

It’s not the most fun part of the process, but it’s the most enlightening. You’ll find out, first, if you can even get a loan for a house. You’ll also find out how much you can borrow and how much you can afford to spend on your monthly payment (which includes interest, taxes and insurance).

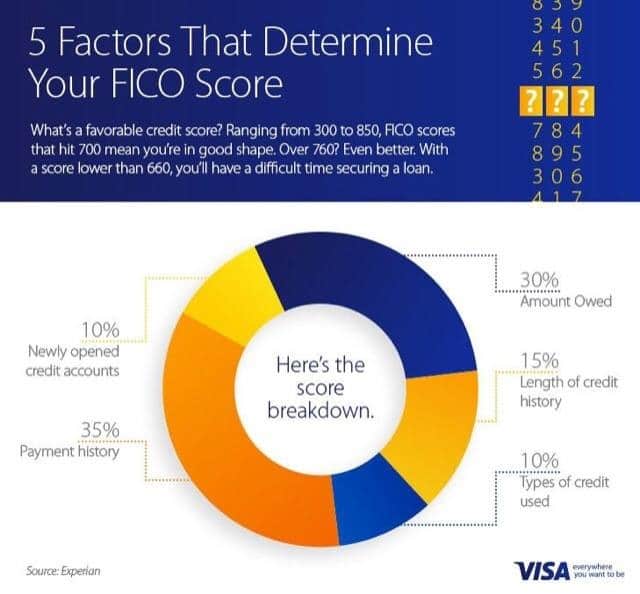

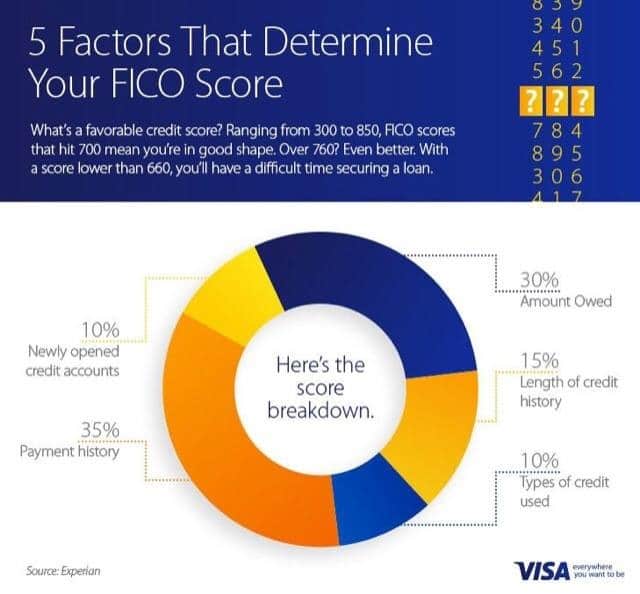

Most lenders today depend on your FICO score. FICO is short for Fair Isaac Corporation, based out of California. Your score, from 300 to 850, will determine several things to the lender, most important of which is your interest rate.

Here’s how your Score is Calculated

It’s a secret, really. What we do know is that Fair Isaac combs your credit reports from Experian, Equifax and TransUnion for tidbits of information on how you’ve used credit in the past and how you use it now. Here are some of the elements of your credit reports that are scrutinized:

- Payment history – how much you owe and the highest amount ever owed

- Type of credit used – installment loans, credit cards, etc.

- Length of your credit history

Your payment history accounts for 35 percent of your credit score. Late payments will naturally lower your score but what many people don’t know is that recent late payments cause significantly more harm than older late payments.

The next most significant aspect of your credit reports is the amount of open account balances. If these balances are within 30 to 40 percent of your credit limit, you’re fine. If they are more than that, your credit score will take a hit.

Fifteen percent of your FICO score is based on the length of your credit history. FICO says they will look at “how long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts.”

The final 20 percent of your FICO score is split between being based on newly opened credit accounts and types of credit used. The latter might include credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. They aren’t necessarily looking to see that you have a balanced mix of types, so don’t rush out and open an account you may be lacking.

Which leads us to the other 10 percent: new accounts. Opening more than one credit account in a short period of time may cause them to think of you as being a bigger risk, especially if you lack a long credit history. If you’re planning on buying a new house, refrain from applying for credit anywhere other than with your mortgage lender.

The bottom line is that the lower your credit score is the more of a risk you present to a lender. If you have a score lower than 620, you may get a loan but you’ll pay dearly for it. If your score is above 720, on the other hand, you’ll be considered an excellent risk.